The best mortgage calculator in Sweden

Everyone dreams of owning a place. Whether it is an apartment, condo, or a full-fledged house, getting a place of your own requires loads of essential steps. What starts from planning ends with savings and includes everything in between.

The same thing happens when you plan to move to a home in Sweden. Before finalizing your dream home, it is essential to determine whether you could take a loan and pay off a mortgage. The blog below discusses in detail every possible thing required to own a place in Sweden. We would also take a look at the mortgage calculator Sweden for making your work easier.

What are mortgages?

Technically speaking, a mortgage is a sum of money usually paid to the bank after taking a loan. Most of the time, it is seen that people take a loan to purchase various things in life. It can be a car, cooperative apartment, or vacation home.

The online mortgage loan is also a good idea if you are planning to renovate the property you are settled in. Irrespective of the fact, one thing is for sure mortgages help a lot when there is an urgent requirement of buying something, and the bank balance doesn’t suffice.

Mortgage providers

So, what are the best mortgage providers in Sweden and which of them offers the best terms and conditions? We have listed below the most frequently used providers in Sweden.

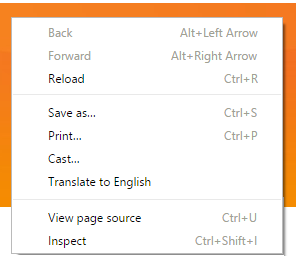

If you land on the website of an loan or mortage provider company (which is often in Swedish), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.

If you land on the website of an loan or mortage provider company (which is often in Swedish), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.

Be aware that Borrowing money costs money

| Borrowing Range | Payment Period | Interest | |

|---|---|---|---|

| Hypoteket SE | 200 000 – 1,000,000 SEK | 1 – 15 years | 2.95 – 15.00 % |

| Lånekoll SE | 10,000 – 600,000 SEK | 1 – 20 years | 2.9 – 26 % |

| Svea SE | 10,000 – 400,000 SEK | 2 – 15 years | 5.79 – 25.95 % |

One of the best mortgage providers in Sweden: Hypoteket

Hypoteket.com is a completely digital mortgage challenger that challenges the big banks with lower interest rates and a simple and smooth process. The mortgage’s interest rates are fully negotiated and quite competitive. Today, an average household can save over SEK 10,000 per by moving their mortgage to Hypoteket.com. Moving your mortgage is easy because Hypoteket takes care of all the work. They also have a great customer satisfaction ratio according to Trustpilot. Feel free to check the website if you want to apply for a new mortgage.

How to apply for a loan in Sweden?

The overall process of taking a loan in Sweden is fairly a simple one. All the applicant will require is a Swedish personal identity number. When you submit the number in the bank, the financial institution checks for your finances and then determines the amount of money you can borrow for the mortgage.

After everything is finalized, you are granted an account from which loan payments are cleared off. Apart from that, there are other considerations to take a look at regarding mortgages:

- Every applicant with a Swedish identity number can borrow up to 85% mortgage value of the property. This can be paid in two installments, 75% as the first mortgage 10% as the second mortgage.

- There is also an additional deposit of 15% of the overall property price.

- You can even have a fixed interest rate on a loan taken for an overall period that lasts from 3 months to 10 years.

How to calculate your monthly costs?

Not many people know this, but the overall cost of owning a place in Sweden is bifurcated into four parts. These are:

Mortgage Loan and Interest:

This is a particular amount that varies according to the financial institution you apply for a loan with.

Amortization:

Amortization is an overall cost that is paid off on a monthly basis. It is another word for mortgage meaning. The amount for amortization is 2% of your loan. Another thing to remember is that whenever the overall price of the property you are about to buy reaches below 50%, the amortization ceases.

Also, if the loan to value exceeds 70%, then the repayment comes down to 2% of the principal.

Housing Association Fee:

The housing association fee is usually paid to the association which owns the building in general.

Utility Costs:

Utility costs are the minimum payment that is made in Sweden. These include heating, electricity, wi-fi package, and free water.

How to calculate the down payment?

Down payment is an amount that is free from the mortgage loan schedule. It is the price that an owner pays initially when the property is purchased. Whenever you buy an apartment in Sweden, the down payment amount is readily available in your Swedish bank account, and once the deal is made, it is transferred to the seller.

These are facts on which the down payment adheres to:

- The money transferred as a down payment is 15% of the apartment value.

- If you have a lower income by any chance, then the amount becomes > 15% as per Swedish law. Thus, people with limited salaries go for a smaller apartment.

Mortgage amount that can be borrowed:

If your bank is going to fund 85% of your property, then these are the guidelines to follow for the best online mortgage calculator:

- Every buyer can borrow 4.5 times the annual income.

- The loan interest is 30% tax-deductible which means you can pay off the loan at low rates when buying an apartment.

For example, let us take a look at the below transaction.

- You purchase a property of SEK 1 million.

- As the down payment amount is 15%, you pay around 150,000 and loan the rest.

- The amortization is 2% of the remaining amount, i.e., 850,000, and comes to around 17,000 SEK/year.

What are the other things to consider while buying a property in Sweden?

After you have come across the desired property, you wish to buy, and the next thing is to go for mortgage cover insurance. We all know that different banks offer different interest rates; thus, it is essential to check for other banks before zeroing down on the loan possibilities.

In this way, you will get the best deal and know the credit score currently. Apart from this, you shall always collect finances at the bank for a better rate of interest. This means whenever your bank proposes an interest rate, never settle down for it. Instead, negotiate and try to get the best deal as a valuable customer.

Always remember, as a buyer, you shall receive the best no matter what. Thus, never settle for things that do not satisfy you mentally.

Conclusion:

Your dream home can become a reality only if you follow the steps above. We know that the mortgage calculator can only show the amortization amount that has to be paid monthly. But despite all of this, what remains with you is the real deal.

So check for all the interest rates available, credit scores, and then only proceed to make a move. This is the most important thing to do as a buyer; otherwise, all your efforts just go in vain. Also, remember buying a home is a roller coaster ride, thus do not rush and decide carefully.